Last week was a blow for homebuyers as interest rates had their worst week since rates started dropping on October 25th. Inflation numbers were a disappointment to say the least, but there was some hope in the data.

The average 30-year fixed rate conventional loan rose last week to 6.889%!

Inflation Reporting for January - The Fed did NOT get the evidence they need to start cutting rates in March.

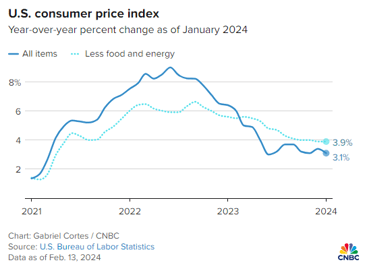

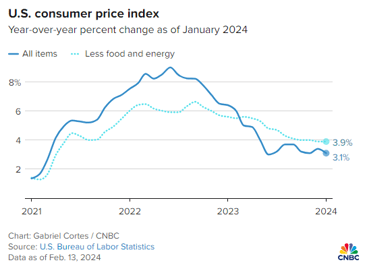

CPI increased 0.3% month over month (vs. 0.2% expected) and 3.1% from a year ago (vs 2.9% expected) and Core CPI (the Fed's preferred inflation calculation) rose 0.4% for the month (vs 0.3%) and 3.9% from a year ago (vs. 3.7% expected).

We're at the point now where if the inflation numbers aren't beating, or at least meeting, expectations - things will get bumpy.

The main issue - to no one's surprise - is still shelter prices, which category climbed 0.6% on the month, contributing more than two-thirds of the headline increase, 6% year-over-year.

The Fed cannot be in a position to cut rates with shelter costs so high. While lowering rates reduces a large part of the shelter cost calculation - demand will surge as buyers flood the market and that will increase prices above and beyond any interest rate savings!

PPI numbers (measuring the price received by producers) also spiked - rising 0.3% for the month, the biggest move since August 2023. Core PPI increased 0.5%, also against expectations for a 0.1% gain.

It was this 1-2 punch of CPI and PPI that caused interest rates to move up so much last week. At least CPI is still trending down, but the faster inflation falls, the faster interest rates will follow.

The Silver Lining For Inflation - Horrible Retail Sales Data

It seems consumer may spending may have run out of steam (at least temporarily).

Retail sales data missed expectations by a long shot.

If consumers stop buying, where else are they pushing back? Hopefully on their landlord when the rent increase comes!

But seriously - if consumers aren't spending enough, retailers will drop their prices to incentivize more spending, which is great for reducing inflation.

Keep in mind consumers make up 68% of GDP! Their wallets are critical to the US economy.

This may be a strong indication that the February CPI numbers will improve.

The supply issues in the Housing Market continue!

One of the main reasons we're seeing such stubborn home prices despite historic low demand in the housing industry is a lack of inventory.

New home builders aren't helping with that. Housing starts and building permits both fell short of expectations last week. Home builder confidence was higher in January, but that confidence needs to show in the amount of housing starts.

Reports vary widely but almost everyone agrees that the US housing market is short about 3.5-6.5 MILLION units of homes, so we need to get to building - and fast!

In other news...

Invitation Homes reaffirmed its love of single family homes this Valentine's Day. The nation's largest single-family rental landlord is buying up to $1B of houses this year. This is 1 company, buying $1B of homes, in just 1 year. This is just a month after Blackstone announced that it was buying 38,000 single family homes - mostly across the Sun Belt. As large corporations continue buying single family homes, home pries will continue going higher and inventory issues will persist!

"To finish the job will take fortitude will need to resist the temptation to act quickly when patience is needed" says Mary Daly San Francisco Fed President after the inflation reports came out last week. She still believes that we will see 3 rate cuts this year, but TBD on when.

US weekly jobless claims are still too low (212k actual vs 220k expected) but layoffs continue. Last Wednesday, Cisco Systems announced it was cutting 4,000 jobs. Hopefully these layoffs start showing up in the data.

Make sure to follow us on Instagram for immediate reactions to all news.

Key reporting dates this week:

Mon, 2/19: President's Day

Tues, 2/20: US leading economic indicators

Wed, 2/21: Fed members speaking

Thurs, 2/22: Initial Jobless Claims, Existing Home Sales, Fed members speaking

Fri, 2/23: None

.png?width=1200&height=244&name=Homebuyer%20Tools%20Header%20(10).png)